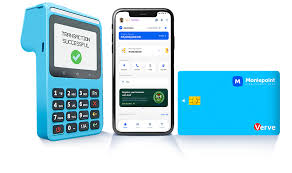

For many small and medium-sized businesses in Nigeria, Moniepoint has become a go-to fintech solution. It’s not just a payments app it offers business accounts, POS (point-of-sale) terminals, and features optimized for merchants. Whether you’re running a shop, a kiosk, or a modern retail business, Moniepoint aims to make money movement seamless, accessible, and cost-effective.

In this review, we’ll dive deep into Moniepoint’s business account features, how to acquire and use its POS devices, the fee structure, cashback rewards for agents, security best practices, and drawbacks you should watch out for. With Moniepoint reaching “unicorn” status and continuing to scale, it’s a compelling option for any growth-minded entrepreneur.

Table of Contents

What Is Moniepoint & Why It Matters for Businesses

Moniepoint is a leading Nigerian fintech company that offers digital banking and payment infrastructure, especially tailored for business users. It provides:

- Business bank accounts for SMEs

- POS (point-of-sale) hardware for merchants

- Payment processing (card payments, cash-out)

- Digital tools for transaction tracking and business management

In 2024, Moniepoint raised $110 million in funding from investors including Google, confirming its rapid growth and strong value proposition for businesses.

How to Create a Moniepoint Business Account

To use Moniepoint’s business services, you first need to open a Moniepoint Business Account. Here’s a general step-by-step process:

- Visit the Moniepoint website or download the Moniepoint app.

- Choose the “Business” or “Merchant / Business Account” option.

- Fill in business details:

- Business name

- Business address

- Business registration details (if required)

- Contact person info

- Provide KYC (Know Your Customer) documents: means of identification, business registration, etc.

- Submit your application. Moniepoint may onboard you with a relationship manager to help with POS terminal setup.

- Once approved, fund your business wallet/account — this will allow you to pay for POS terminal and activation, if any.

Note: When onboarding, be clear about your expected transaction volume. Moniepoint monitors POS performance and may reassign terminals if minimum targets are not met.

Moniepoint POS Terminals Types & How to Get One

Moniepoint offers its signature terminal called the MP35P Smart POS. According to Moniepoint’s own guide:

- The POS is leased, not sold outright.

- The cost for the terminal is ₦21,500, broken down into:

- ₦10,000 caution fee

- ₦10,000 logistics / delivery fee

- ₦1,500 insurance fee for one year

- Process:

- Log into your business account

- Go to Channels → POS → Request New POS

- Select the MP35P device and specify your delivery address

- Fund your account (≥ ₦21,500) to pay for the terminal

- A dedicated Relationship Manager will deliver the terminal (usually within ~48 hours) and train you on usage and support.

Moniepoint Transaction Fees and Commission Structure

Understanding Moniepoint’s POS fees is critical for business profitability. Here are the key charges:

| Transaction Type | Fee / Charge |

|---|---|

| Withdrawals (₦1–₦20,000) | 0.5% of transaction amount |

| Withdrawals (over ₦20,000) | Flat ₦100 per transaction |

| Transfers (POS) | Flat ₦20 per transfer |

| Airtime Top-up (all networks) | 2% of airtime value |

| Bill Payments | According to Moniepoint, no charge for certain bill payments |

These fees make Moniepoint relatively competitive, especially for small business operators.

Cashback & Rewards for POS Merchants

Moniepoint doesn’t just charge fees it also rewards its agents and merchants based on transaction volume. Recent cashback structure:

- Cashback is tier-based, depending on your weekly POS transaction volume.

- Merchants can get up to 15% back on POS fees for withdrawals, purchases, and POS transfers, depending on tier.

- On interbank transfers done via POS, you can earn up to ₦6 back per transfer, again depending on your tier.

- Cashback is credited to a “promo balance” each week automatically — you don’t need to manually request it.

This cashback program rewards active agents/merchants and is especially beneficial for those doing high volumes.

Moniepoint’s Latest POS Device & Features

In August 2025, Moniepoint launched a new touchscreen POS terminal with advanced features:

- Screen with built-in printer: Combined sales record + payment receipt printed in one slip.

- Offline transaction support: The terminal can sync transactions when the internet is restored.

- Backend dashboard: Merchants get detailed reports — inventory, expiry tracking, branch performance (for multi‑branch business), customer groups, and discount configurations.

- Upgrade path: Existing Moniepoint merchants can swap older POS devices for the new one without paying full cost Moniepoint leases it.

This makes Moniepoint’s ecosystem more scalable and business-friendly.

Security & Risk Management

Security is a major concern for fintech and POS operations. Here’s how Moniepoint handles it, and what you as a merchant should do:

- Leased POS: Because the POS is not sold outright, Moniepoint retains some control and can manage risk by retrieving underperforming or misused devices.

- Relationship Management: Each merchant is assigned a Relationship Manager who provides support, helps with onboarding, and addresses disputes.

- Transaction tracking: The POS dashboard (backend) tracks withdrawals, transfers, sales, useful for spotting irregularities.

- Agent performance requirement: Moniepoint expects daily performance (minimum ₦80,000 daily transaction target for POS) this acts as a deterrent against inactive or fraudulent POS usage.

- Cashback incentives aligned with volume: Encouraging volume helps validate active terminals and reduce dormant/fraud risk.

Pros and Cons

Pros:

- Low upfront POS cost via leasing (₦21,500).

- Cashback rewards can significantly offset transaction fees.

- Robust POS hardware (new touchscreen version) with offline sync and reporting.

- Strong support structure via Relationship Managers.

- Growing trust: Moniepoint has raised major capital, including from Google, signaling stability and scalability.

Cons:

- To retain POS terminal, merchants must meet a relatively high daily volume target (₦80,000) may be difficult for very small operations.

- Some fees (especially withdrawal fees) might cut into margins for businesses with frequent cash-out.

- Insurance, logistics, and caution contributions make the initial cost non-trivial despite leasing.

- Cashback depends on weekly tiers inconsistent business volume may limit your rewards.

Expert Recommendations for Business Owners

- Evaluate your daily transaction volume: If your business can hit Moniepoint’s daily target, the POS makes sense and can be very profitable.

- Use cashback strategy: Try to operate in a way that maximizes your weekly tier you’ll get more cashback on fees.

- Train your staff: Make sure your POS users know how to use offline mode, print receipts, and sync data helps prevent lost transactions.

- Maintain good POS care: Since the terminal is leased, mishandling may hurt your relationship and cashback.

- Leverage your RM: Relationship Managers can help with scaling, resolving disputes, and optimizing your transaction mix.

FAQs

Q1: Is Moniepoint POS actually owned by the merchant?

A: No, Moniepoint leases the POS device. Merchants pay a caution fee, logistics, and insurance, but the device remains Moniepoint’s property.

Q2: What happens if I don’t reach the daily transaction target?

A: According to Moniepoint rules, terminals that don’t reach the ₦80,000/day threshold may be reassigned.

Q3: How much can business owners earn back in cashback?

A: Merchants can potentially earn up to 15% of POS transaction fees back, depending on their cashback tier.

Q4: Are there hidden fees for bill payments?

A: According to Moniepoint’s published POS fee structure, bill payments currently attract no charge.

Q5: How do I request a Moniepoint POS terminal?

A: In your Moniepoint business account → go to Channels, click POS, then Request New POS, pick the MP35P terminal, fund the terminal cost (₦21,500), provide delivery address, and Moniepoint will send a Relationship Manager.

Conclusion

Moniepoint offers a powerful, business-focused fintech solution built for merchants in Nigeria. With its leased POS model, cashback rewards, strong support structure, and real-time backend reporting, it’s ideal for merchants who want to scale smartly. The recent launch of a more advanced POS terminal underscores Moniepoint’s commitment to innovation and merchant success.

However, it’s not a plug‑and‑play free service: businesses must hit transaction targets, and there are initial costs to cover. If you run a medium-to-high volume business or are confident in your sales trajectory, Moniepoint POS could be a game-changer.

For businesses just starting out, evaluate expected volume and test how much cashback you can realistically earn. If it aligns, Moniepoint may well be among the most competitive and scalable POS options available in Nigeria right now.